Table of Contents

Why Is Bitcoin Falling? (September 2022)

Why is the bitcoin falling news page breaking news and current information about why bitcoin is falling? According to a series of macro warnings from Goldman Sachs, Bitcoin is at risk of hitting $12,000. Bitcoin (BTC) is at risk of crashing to $12,000, according to a series of macro warnings from Goldman Sachs.

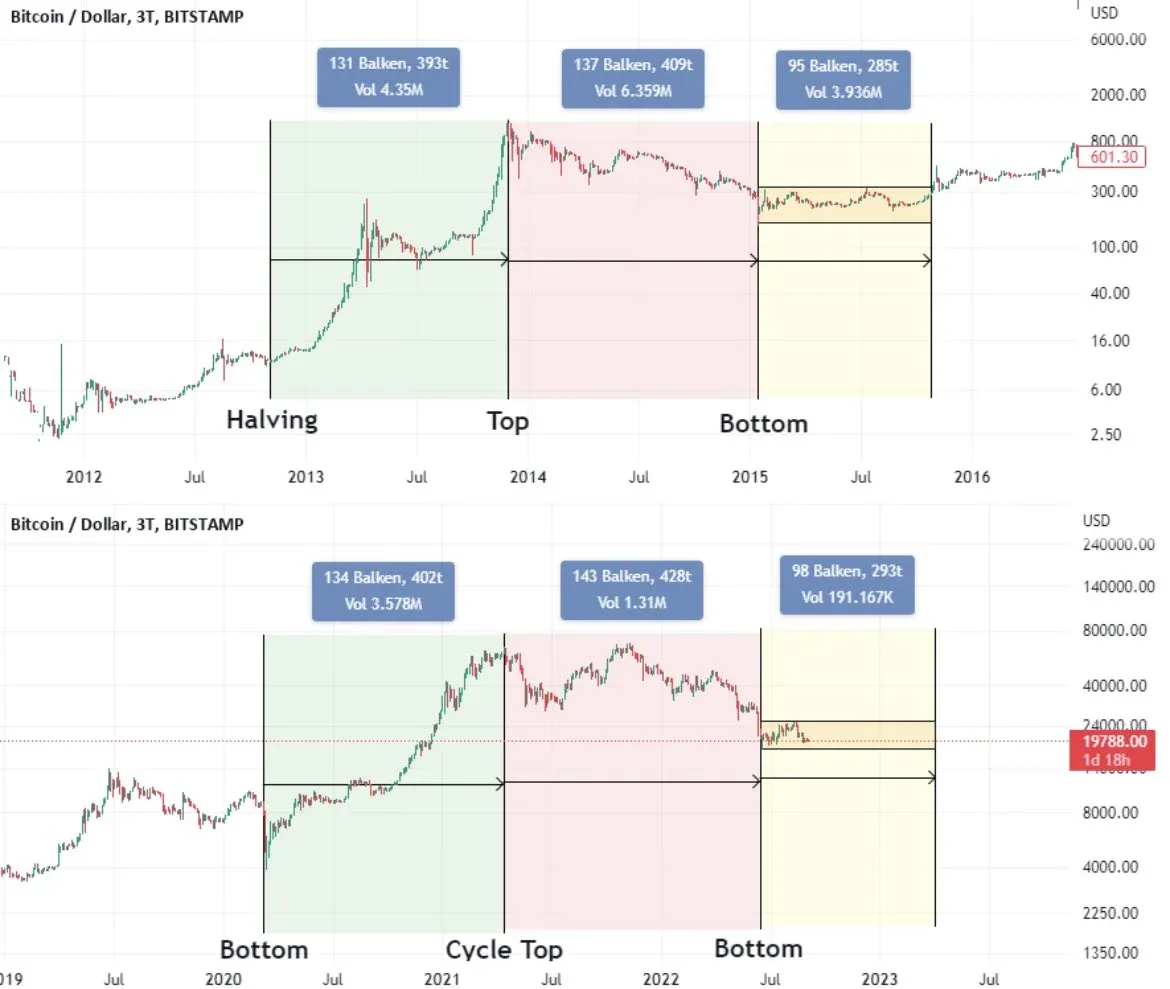

Is Bitcoin in its Dip stage?

The team of Goldman Sachs economists, led by Jan Hatzius, raised their forecasts for the pace at which the Fed would raise benchmark interest rates. According to economists, the central bank will increase interest rates by 0.75 percent in September and 0.5 percent in November. Economists had previously predicted these rates to be 0.5 and 0.25 percent, respectively.

The Fed's rate hike roadmap plays a key role in determining Bitcoin's price trends in 2022. The period spent with high loan rates (it went from near zero to 2.25-2.50 percent in a few months) led investors to avoid risky assets and take refuge in safer alternatives such as cash.

Bitcoin, which has lost almost 60 percent of its value since the beginning of the year, is now trying to rise above the psychologically important $20,000 support. Some analysts, including the anonymous investor Doctor Profit, think that the BTC price is at the bottom at current levels. On the other hand, the investor also warns:

Please consider the next decisions of the FED. The 0.75 percent interest rate is already priced in. If it is 1 percent, blood will go up.

Bitcoin's positive correlation with US stock markets, particularly the tech-focused Nasdaq Composite, also deepens the risk of a correction.

Sharon Bell, a Goldman Sachs strategist, warned that current rallies in the stock markets could be bull traps. Goldman Sachs had previously said that stock markets could drop 26 percent if the Fed accelerates rate hikes to combat inflation.

In parallel with the warnings, the number of short Bitcoin positions opened by institutional investors increased.

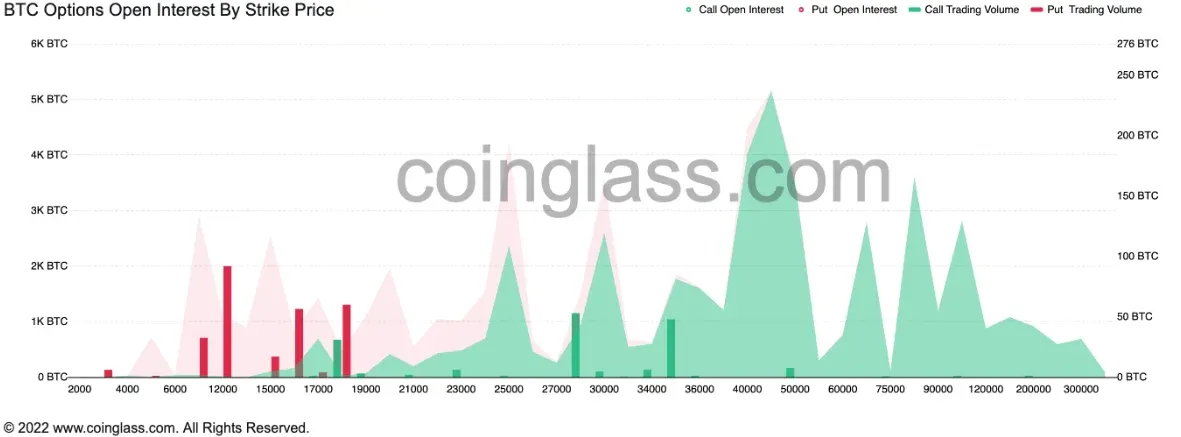

Expected 12 Thousand Dollars in Options Market

Bitcoin options, which expire at the end of 2022, show that most investors expect a decline to the $10,000-12,000 band.

The open interest rate of call and put options are measured at 1.90 as of September 18. Buy orders above $45,000 seem to have the highest weight. In the $10,000-23,000 range, at least four sell orders have been placed for every three buy orders, which may offer an opportunity to better examine market sentiment. From a technical point of view, Bitcoin price may decline to $13,500 with a decrease of about 30 percent according to the inverted cup and handle formation on its chart.

On the contrary, if the 50-day exponential moving average (red wave) near $21,250 is cleared, BTC could rise towards its next psychological target of $25,000.